In order to ensure accurate CPP and EI calculations and prevent exceeding the annual maximum employee's historical payroll data for the current payroll year prior to onboarding with Knit is required. Reporting accurate year-to-date (YTD) information is essential for year-end reporting and T4 filing.

Note: Before you start reporting the year-to-date figures, please ensure that all your income and deduction types are setup so that the input sheet will show the income and deduction column of the income or deduction type. For instructions on how to setup income and deduction type click here.

Step 1: Current Employees

Ensure all current employees are added to the list on this page. If any employees have been missed, please add them before proceeding. Once all current employees are added, save your progress by clicking the "Save" button at the bottom right corner of the page.

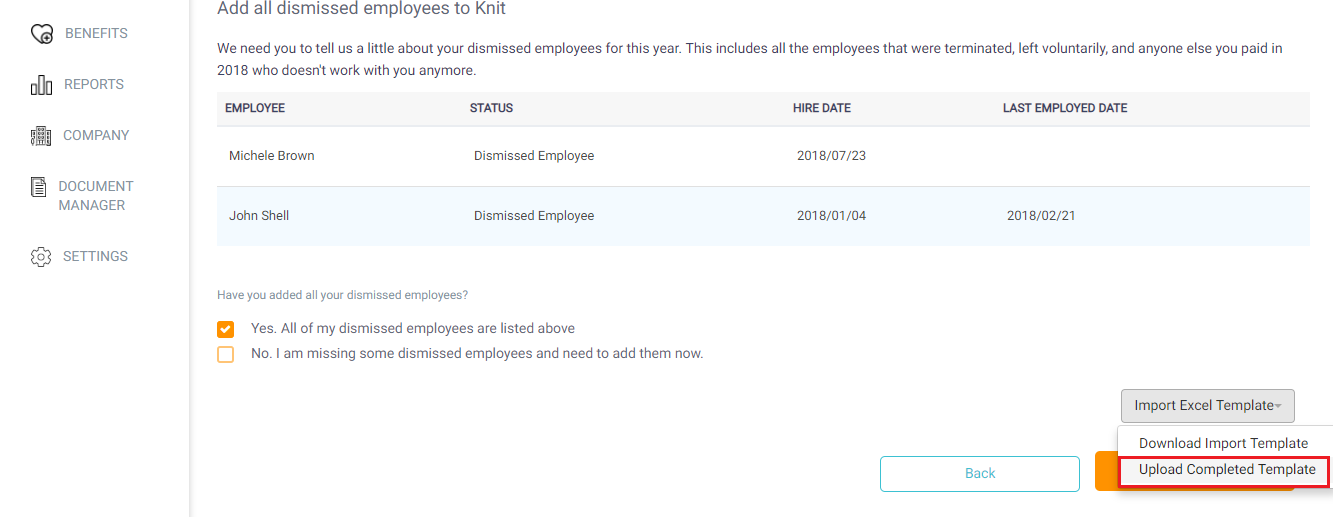

Step 2: Dismissed Employees

On the Dismissed Employees page, please provide the following details for employees who were dismissed and received payment during the current payroll year. You can enter the information manually or use the provided import template for convenience. These employees will be included in the company's T4 package at year-end. The required information includes:

- First & Last Name

- Social Insurance Number

- Mailing Address

- Job Title

- Hire Date

- Termination Reason

Step 3: Employees Year-to-date

Important Note:

To ensure accurate filing of your year-end tax returns, we require information regarding the payroll you have processed since the beginning of the year. Please refer to the paystubs or payroll register of your most recent payroll to obtain the most up-to-date Year-to-Date (YTD) information.

Please be aware that employees who have no Employee/Employer CPP, Employee/Employer EI, or Gross pay will be marked as unpaid and will not be included when saving the information.

Uploading your YTD information is a non-transactional process aimed at ensuring accurate record-keeping. It does not involve any debiting of funds from your bank account. The uploaded data is used solely for the purpose of accurately completing your year-end tax returns.

Importing Year-to-date

Choose one of the two options to enter Employees Year-to-date (YTD) information:

- Option 1: Enter the historical payroll data directly on the platform.

- Option 2: Use our YTD Import Excel template for easier data entry.

Select the option that works best for you to proceed with entering the necessary YTD information.

Entering Year-to-date Manually

To input the Year-to-Date (YTD) information manually, please enter your employees' total historical earnings for each income and deduction type relevant to the current payroll year. Once you have entered all the necessary data, and you are ready to add it to your company's profile, simply click the orange "Save" button located at the bottom right corner of the page.

Importing Year-to-dates using the Excel Template

For greater efficiency, we recommend using the Excel template if you have more than 5 employees included in the historical payroll data. The template allows you to save your work in progress and resume at a later time, ensuring a seamless and convenient data entry process.

Before using the YTD Import Template, please ensure that the following steps have been completed:

- All employees have been added to the system.

- At least one pay group has been set up.

- All income types (e.g., Holiday Pay, Commission) and deduction types (e.g., Life Insurance, Long-term Disability) have been created.

This is essential to ensure that both the manual entry screen and CSV download accurately reflect the information you have previously added. If you add more employees, income types, or deduction types after downloading the template, you will need to download a new template for importing.

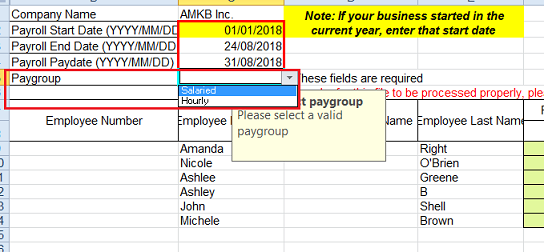

When using the YTD Import Template, please keep the following in mind:

- Payroll Start Date: Set the Payroll Start Date as January 1st, unless your business started in the current year.

- Payroll End Date: Take into account the Payroll End Date. The YTD entry in Knit reflects the most recent payroll end date. If you plan to run a final payroll outside of the Knit platform, include those numbers in the YTD entry.

-

Pay group: Use the drop-down menu to select a Pay group. Ensure that at least one pay group has been created before downloading the YTD Import Template. Note that employees who belong to a different pay group than the one selected will not be affected.

When filling out the YTD Import Template, please use the following guidelines for each column:

-

Regular Pay: Include only regular pay in this column. Do not include other income types, such as vacation pay, statutory holiday pay, bonuses, commission, etc.

-

Time Worked on Holiday: Enter the hours and pay for employees who physically worked on holidays. For employees who received statutory holiday pay without working, add that amount to the Holiday Pay column.

-

Vacation Pay: Enter the amount of vacation paid out and the corresponding hours of vacation taken by employees.

-

Vacation Pay Balance: Enter the vacation balance that has been accrued but not yet paid out.

-

Federal Tax and Provincial Tax: Enter the applicable amounts for federal and provincial taxes. If your taxes are combined for both federal and provincial purposes, you can input the total amount under "Federal Tax" and leave the "Provincial Tax" field blank.

-

Employee and Employer CPP and EI contributions: Enter the respective amounts for CPP and EI contributions made by both the employee and employer. If you are unsure what the employer's portion of the EI or CPP is, you can calculate them manually. The employer's portion of CPP equals the employee's portion of CPP, while the employer's portion of EI is calculated as 1.4 times the employee's portion of EI.

-

Gross Pay: Enter the gross pay amount for each employee.

-

Net Pay: Enter the net pay amount for each employee.

- Amount Paid: Enter the total amount paid to each employee.

Once you have completed the template, you can upload it into Knit for data import and processing.