Knit will now enable you to create any income type that you need, by creating a custom income type.

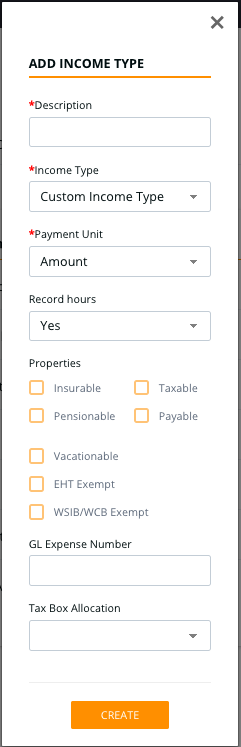

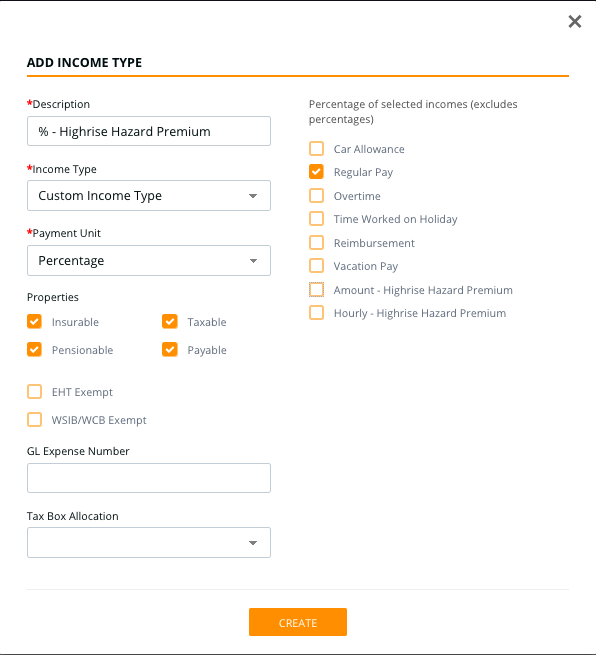

To create a custom income type, navigate to Run Payroll > Income Types > Add New Income Type, then select "Custom Income Type" in the Income type dropdown.

With a custom income type, you can control both how the income is calculated and if it applies to taxes, vacations, EHT, etc.

Payment Units

There are three payment units to choose from:

- Amount

- Per Hour

- Percentage

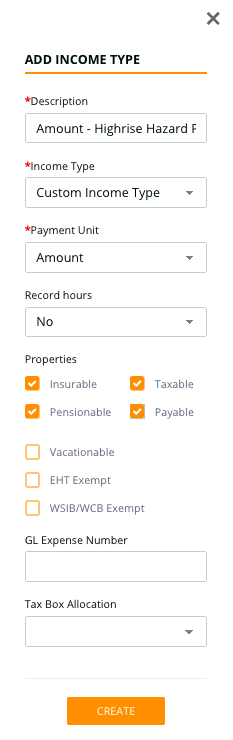

1. Amount

The amount payment unit is for income types that will be set as a lump sum, for example, a monthly parking taxable benefit. Note that this income type can still be configured to accept hours, or just a dollar amount.

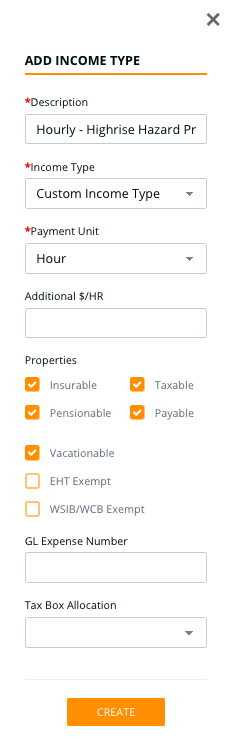

2. Per Hour

When selecting an hourly custom income type, you have the option of setting it to automatically add an amount to the employee's regular pay rate.

3. Percentage

The percentage custom income type will allow you to select what this income type will be a percentage of. When you select percentage from the income type drop-down menu, all your company's income types will be available to choose from on the right.

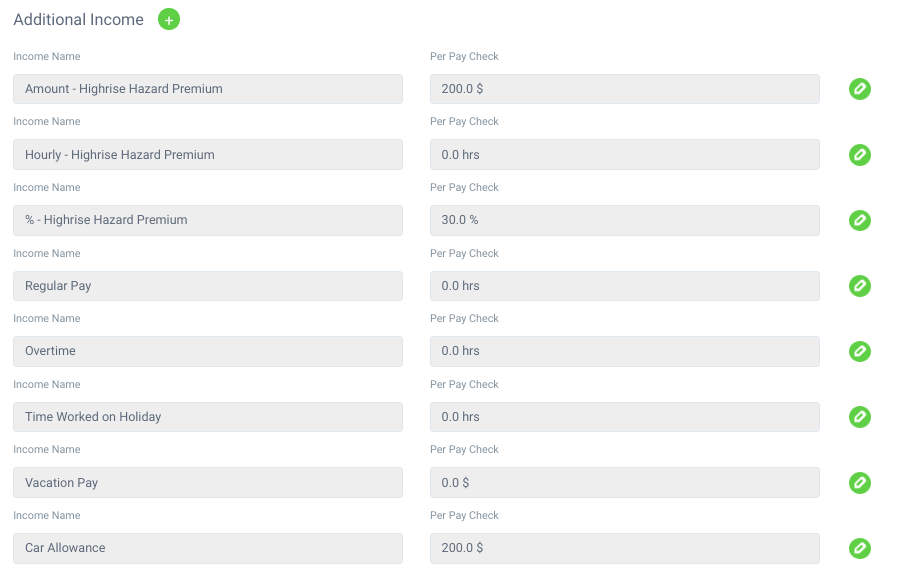

Setting Default Amounts Per Employee

To simplify the use of custom income types, we gave users the ability to set a default amount to be included in every payrun. To control these settings, open the employee's profile under the People Tab, navigate to Compensation, then scroll down to the Additional Income section.

Here, you will be able to assign a default amount for each custom income type, to be included automatically in every payrun.