Creating a Deduction Type

- Click on the Run Payroll Tab on the left side

- Click on the Deduction Types tab along the top

- On the far right side, click on the option to Add New Deduction Type

- A display box will appear where you can start entering the details for the Deduction Type starting with the Description

- In the Deduction Type field, use the drop down menu to select the Deduction Type you would like add

- The next field is the Deduction Option field which allows you to choose the what the deduction will be based on - Per Hour, Amount or Percentage.

- GL expense and liability codes can also be entered in the following two fields if necessary

- Click on the orange Create button to create the Deduction Type

Assigning Deduction Types

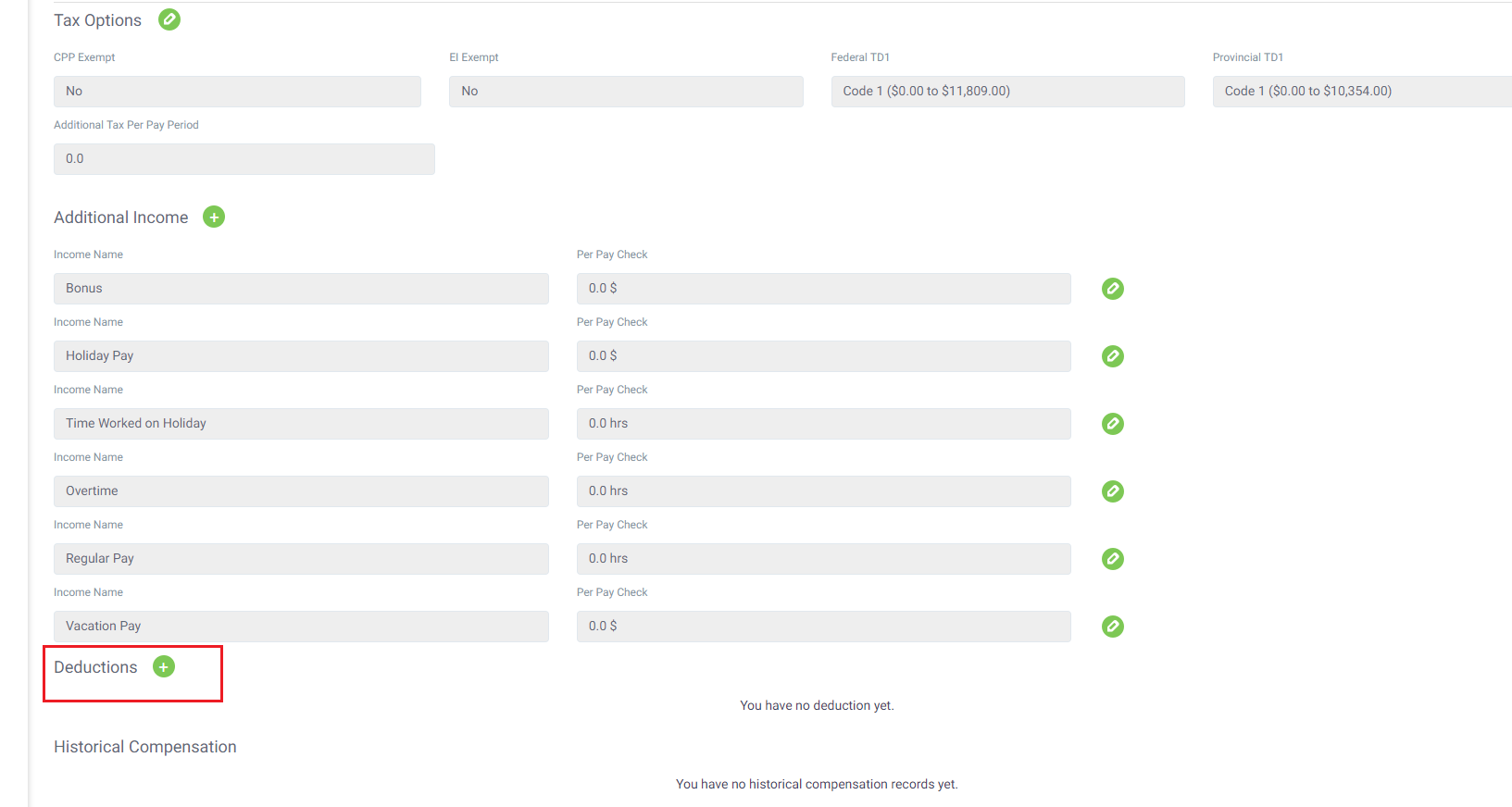

- You can now assign this Deduction Type to employees by clicking on the People tab

- Click on the employee you would like to assign the Deduction Type to

- Once in the employee's profile, click on the Compensation tab along the top

- At the very bottom of this page click on the Green plus sign next to Deductions

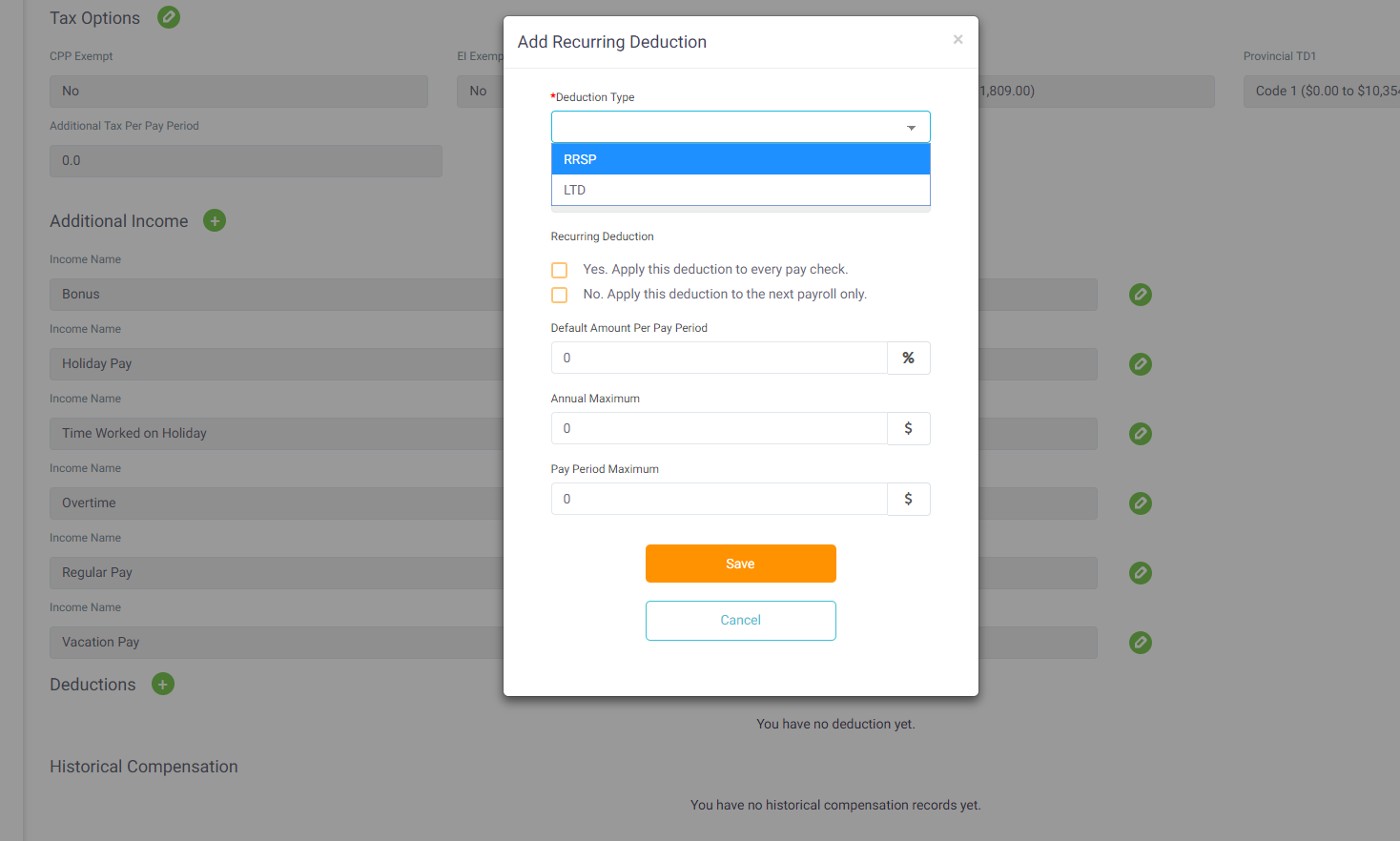

- The first field in the display box will allow you to select the previously created Deduction Type from the drop down menu

- You can also choose to have the deduction applied to every paycheck or just the next payroll run

- Finally, you can enter any annual or per pay period maximum amounts if applicable. The system will automatically track these amounts and once the maximum is reached, the deduction type will stop being deducted

- Go ahead and click the Save button

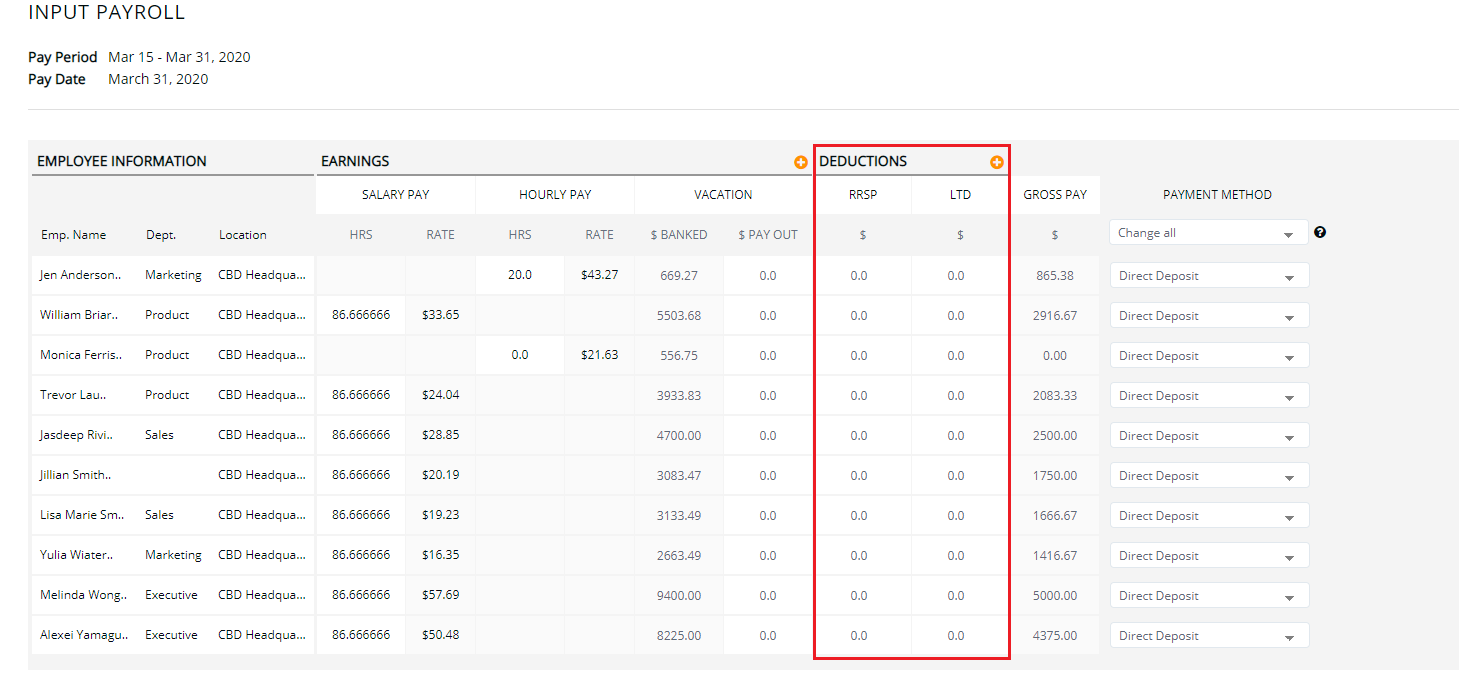

- Alternatively, you can choose not to assign Deduction Types to specific employees, and enter these amounts manually in the Input Payroll screen by clicking on the orange plus sign next to Deductions once the Deduction Type has been created (this can be useful for a one time deduction or for deductions that may not necessarily be deducted on each pay check)