With Knit, you can conveniently process third party payroll payments — for example donations deducted from salaries, benefits payments, or payments to RRSP management companies.

Here you'll learn how to set up payees, select non-payable incomes/deductions to be associated with the payee, make payments to the payee, and also get a report broken down on a per-employee basis. (Note: Knit does not send these reports to the 3rd parties, this has to be done by the employer or payroll administrator.)

Overview

- The 3rd party payee feature is only available for non-payable income types and most deductions.

- If a Payee is no longer needed, it can be set to inactive. Once set to inactive, they will also be removed from non-payable incomes/deductions that they are associated with.

- Once you select a debit option, it will apply to the next payroll run on our system.

- Payee information only applies to the pay runs when the payee setting is available at the time of the pay run. If payees are assigned/removed before the pay run, it will apply to pay runs going forward. Knit does not handle debits to payees retroactively, for previously ran payrolls.

1. Setting up 3rd Party Payees

To Create a new external/third party payee:

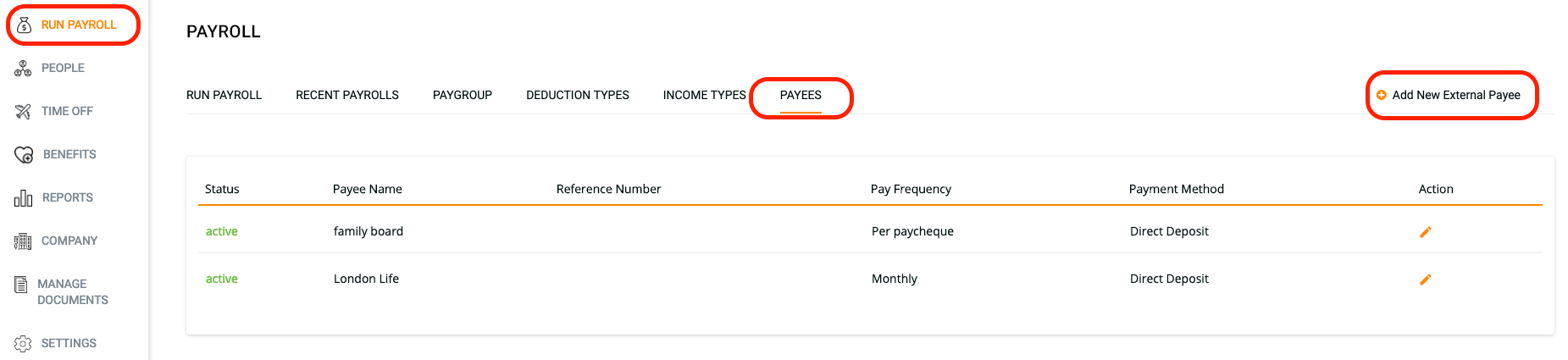

- Starting from the Run Payroll view, click the PAYEES menu.

- From PAYEES, click "Add New External Payee"

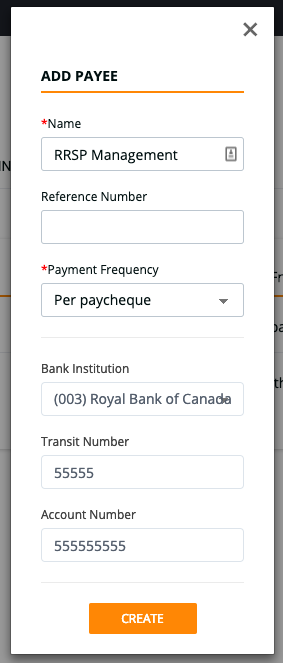

- Fill in the form with your Payees direct deposit information (NOTE: it is up to the user to make sure the banking information is 100% accurate. Any typos or wrong direct deposit information will result in money being sent to the wrong account. The user takes on sole responsibility for recovering incorrectly distributed funds in the event that they provide Knit with incorrect information.)

- When choosing your Payment Frequency, you can decide if you want to pay the 3rd party payee every pay period, OR just once a month. If you choose to pay once a month, Knit will collect any payroll deductions (both complete and pending) submitted 3 business days before the end of the month, and send them to the payee as a lump sum.

- IMPORTANT: Once chosen, you will NOT be able to edit the Payment Frequency later. Please make sure you select the correct one.

- Once the form is completed, hit CREATE, and your payee will be saved in the system.

2. Adding 3rd Party Payees to a Specific Income or Deduction Type

In order to make payments to 3rd parties, you will need to assign the Payee to a specific Income or Deduction type. You can assign a single payee to as many different income or deduction types as you wish.

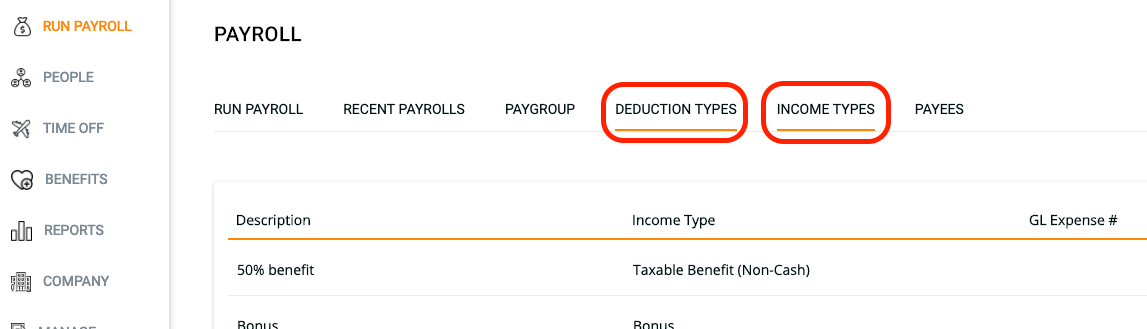

- Navigate to the DEDUCTION TYPES or INCOME TYPES menu.

- Create a new non-payable income/deduction type OR click on a existing income/deduction type to edit

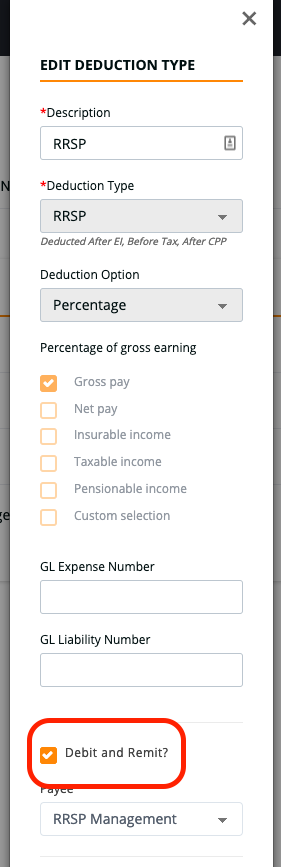

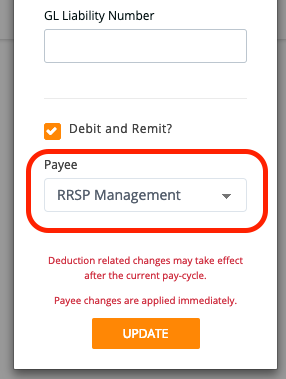

(To learn how to set up income and deduction types, go here: https://help.knitpeople.com/payrolls/creating-and-assigning-deduction-types) - At the bottom section of the pop-up menu, check the option for Knit to "Debit and Remit" the Income or Deduction

- Then, choose the Payee account from the dropdown below — this is where payments for this income/deduction type will be made

- Once you complete and submit the form, the non-payable income/deduction will be created/updated, and a payee assigned to it. You will be able to use it in your next payroll.

3. Processing Payments to 3rd Party Payees

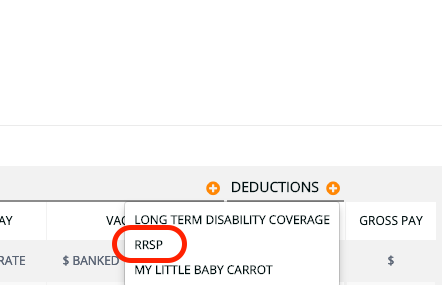

- In order to process the payments, all you have to do is run payroll as usual and select the non-payable income/deduction type you have set up from the dropdown menu and add the amount.

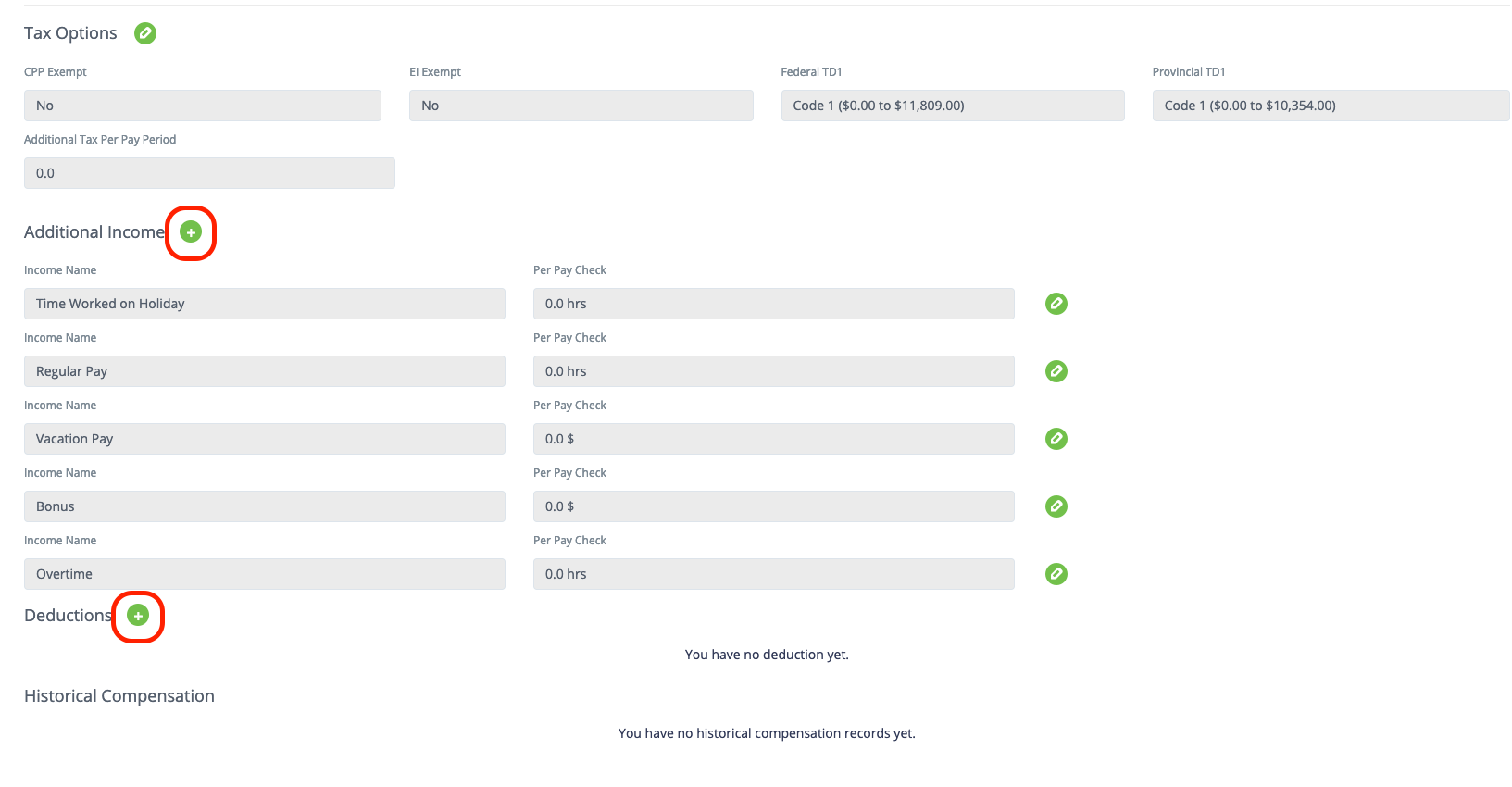

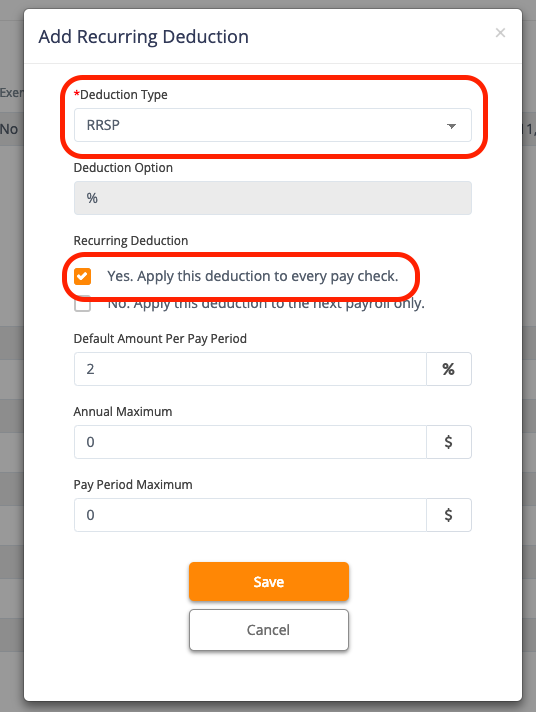

- If the non-payable income or deduction is a constant, recurring amount, you can set it to populate in every payroll automatically. Do this by going to the PEOPLE menu, selecting a specific employee, clicking the COMPENSATION section, and adding it to the employee's Income or Deduction module (found at the bottom section):

- And that's it, you're all set with automatically making payments to 3rd Party Payees!

4. How to stop making payments to 3rd Party Payees

Once a payee is set up with an income/deduction, amounts included in the income/deduction will be sent to the payee selected. If/when you wish to stop processing those 3rd party payments, you can do one of two things:

- Uncheck the checkbox for Knit to debit and remit to the payee (found by editing your existing Income or Deduction type — see Section 2, Point 3 above)

- Set the payee to inactive and payee will be removed from all associated incomes/deductions

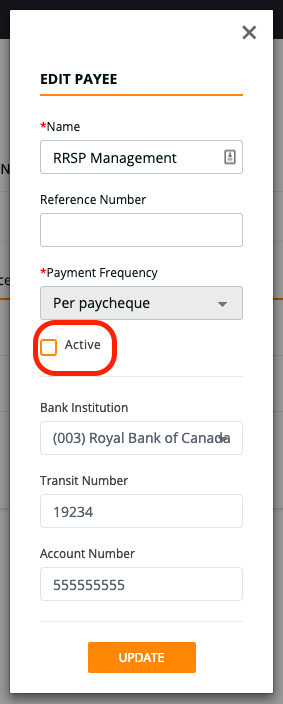

To set a payee to inactive:

- Click on Run Payroll

- Go to PAYEES tab

- Click the edit icon on the right side

- Uncheck the "Active" checkbox

- Hit UPDATE

5. Getting reports about payments to 3rd Party Payees

You may wish to report on how much you have paid in third party payments.

Knit offers you a report that gives a total breakdown, and also allows you to see a per employee breakdown.

This can be used for your own reporting, or for submitting the breakdowns to the third party in .pdf or .csv format if required (Knit does NOT submit reports to 3rd parties on your behalf).

To find the report:

- Click on Reports

- Under Payroll reports, scroll down and look for "Payee Remittances"

- Click into the report and change the date range if required to pull data from that date range.

If you have any additional questions or need assistance, please contact us at support@knitpeople.com, or during standard business hours at +1 (877) 763-8808.