For various reasons, some of your employees may be tax exempt (for example, EI exemption for shareholders/owners who take a regular salary). You can easily set up these exemptions through the employee's Knit profile.To add an employee tax exemption:

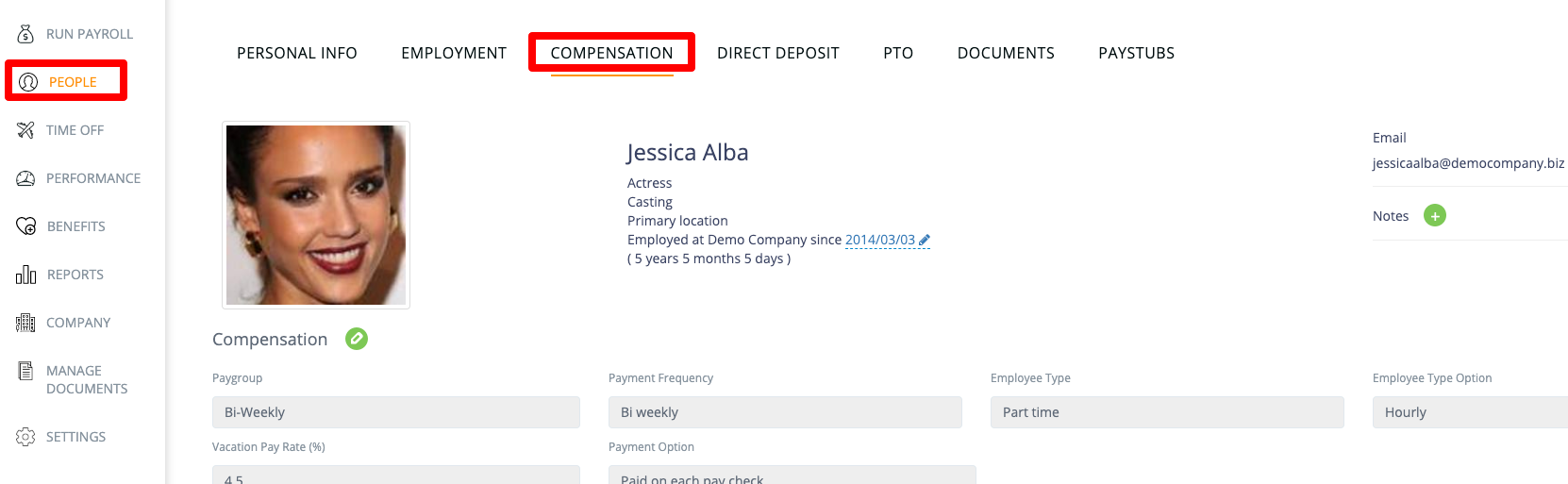

- Open the People tab and select the tax-exempt employee.

- Once you inside the employee profile, select the Compensation tab.

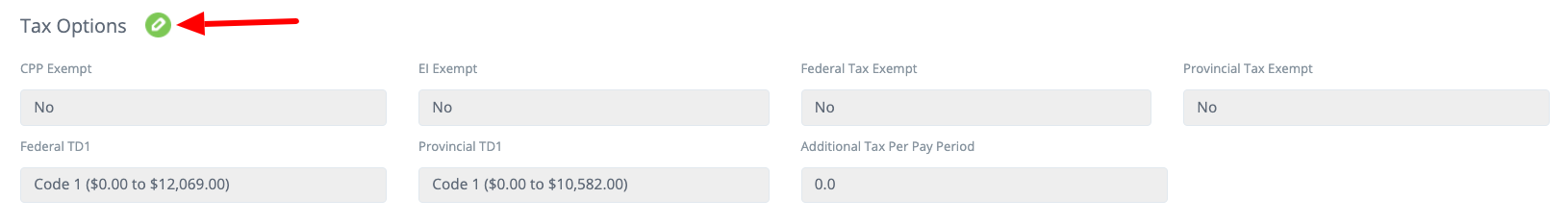

- Scroll down to Tax Options and select the green pencil Icon, the Edit Tax Options window will open

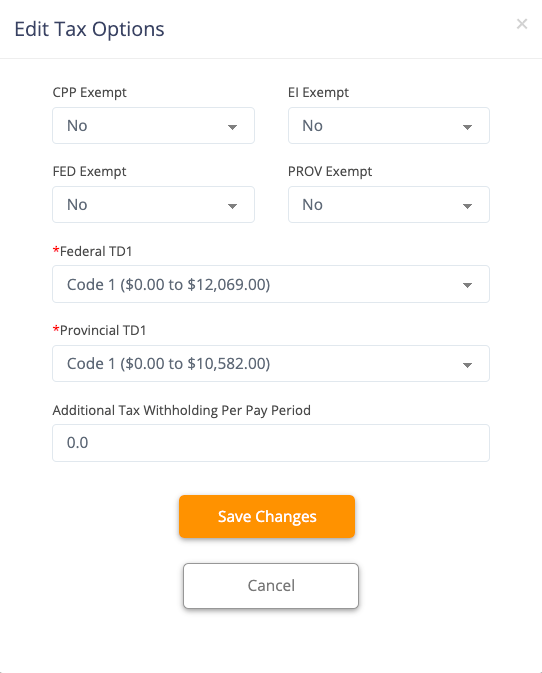

- To make the employee exempt from either Provincial taxes, Federal taxes and/or CCP & EI contributions, simply select "Yes" from the drop-downs under the correct remittance

- Click Save Changes