Important dates

Friday, February 20th, 2026, at 8pm EST

The deadline to confirm your T4s for submission via Knit on your organization's behalf. While you can still utilize Knit to generate T4s after this deadline, it becomes your responsibility to electronically file them with Canada Revenue Agency (CRA). For detailed instructions on how to electronically submit your T4s, click here.

Monday, March 2nd, 2026

The deadline to confirm your T4s for submission to the Canada Revenue Agency (CRA). Failure to submit T4s by the CRA deadline may result in fines ranging from $125 to $2,500.

Preparing to file your T4s

Payroll/Business Number

Before filing your T4s, ensure that you double-check your CRA Payroll/Business number. Confirm that the CRA Payroll number matches with the one on your PD7A filing. Additionally, verify that your company name matches the business name registered with the CRA. If there is a discrepancy in the names, please contact support@knitpeople.com and request to change the legal name of the business.

Employee Information

Ensure that employees are correct by navigating to People. Click on the Employees and utilize the Mass Changes tool. Ensure that the employee's first name, last name, date of birth, social insurance number (SIN), address, including their postal code, are all accurate.

Accessing your T4 Package

Navigate to Reports. Click on Year-End and select the year you would like to generate T4s.

Verify Income Types

On the Verify Income Types page, ensure that all income types are correctly mapped to the corresponding T4 box. The chart will provide information on whether Knit will include the income type in the employees' T4 box 14 total or if it is associated with another T4 box or linked to a third-party payee.

To modify the T4 box mapping for income types, click on the three action dots and choose Edit. The Edit Income Type window will appear, allowing you to select the appropriate T4 box number from the Tax Box Allocation drop-down menu. Save your changes by clicking the Save button.

After reviewing and adjusting the income types T4 mapping settings, click the orange Confirm Income Types button located in the bottom right corner of the page.

Verify Deduction Types

On the Verify Deduction Types page, you will ensure that all deduction types are correctly mapped to the appropriate T4 box.

To modify the mapped T4 boxes for deduction types, click on the three action dots and choose Edit. This action opens the Edit Deduction Type window, where you can select the T4 box number from the Tax Box Allocation drop-down menu. Save your changes by clicking the Save button.

After reviewing and adjusting the T4 mapping settings for deduction types, click the orange Confirm Deduction Types button located in the bottom right corner of the page.

Employer Offered Dental Benefits (Box 45)

While the CDCP will only be available to qualifying individuals, its implementation requires a new reporting requirement of employer-provided dental coverage. Starting in the 2023 tax year, there will be a reporting requirement of employer-provided dental coverage. Reporting details will include whether an employee, former employee, or a spouse of an employee was eligible as of December 31 to access dental insurance or dental coverage of any kind in the reporting tax year - whether they chose to access that care or not. Employers do not have to report whether an individual made use of the dental insurance or coverage.

The coding options are as follows:

- Code 1 – the payee does not have access to any dental care insurance or coverage of any kind.

- Code 2 – the payee is the only one with access to dental care insurance or coverage of any kind under the payee’s plan.

- Code 3 – the payee, their spouse, and dependents have access to dental care insurance or coverage of any kind under the payee’s plan.

- Code 4 – only the payee and their spouse have access to dental care insurance or coverage of any kind under the payee’s plan.

- Code 5 – only the payee and their dependents have access to dental care insurance or coverage of any kind under the payee’s plan.

Select year-end employee T4s

This page displays a list of current and former employees who received payments during the payroll years. Check the boxes next to the employees you wish to include in the T4 filing. If you prefer to include all employees in the list, select the checkbox to the left of the Employee heading. Click on "Generate T4s" to proceed to the next page.

Review Modify T4 drafts

On this page, you can review a preview of the employees' T4s. It's important to note that, at this stage, the T4s are not considered final. Any necessary edits to individual T4s must be made at this step. If modifications are required, select the pencil icon located to the left of the navigation arrows.

Once you have completed the T4 edits, click the orange "Confirm T4s" button in the bottom right corner of the page. You can still review both the T4s and T4 summary on the next page before officially submitting the T4s.

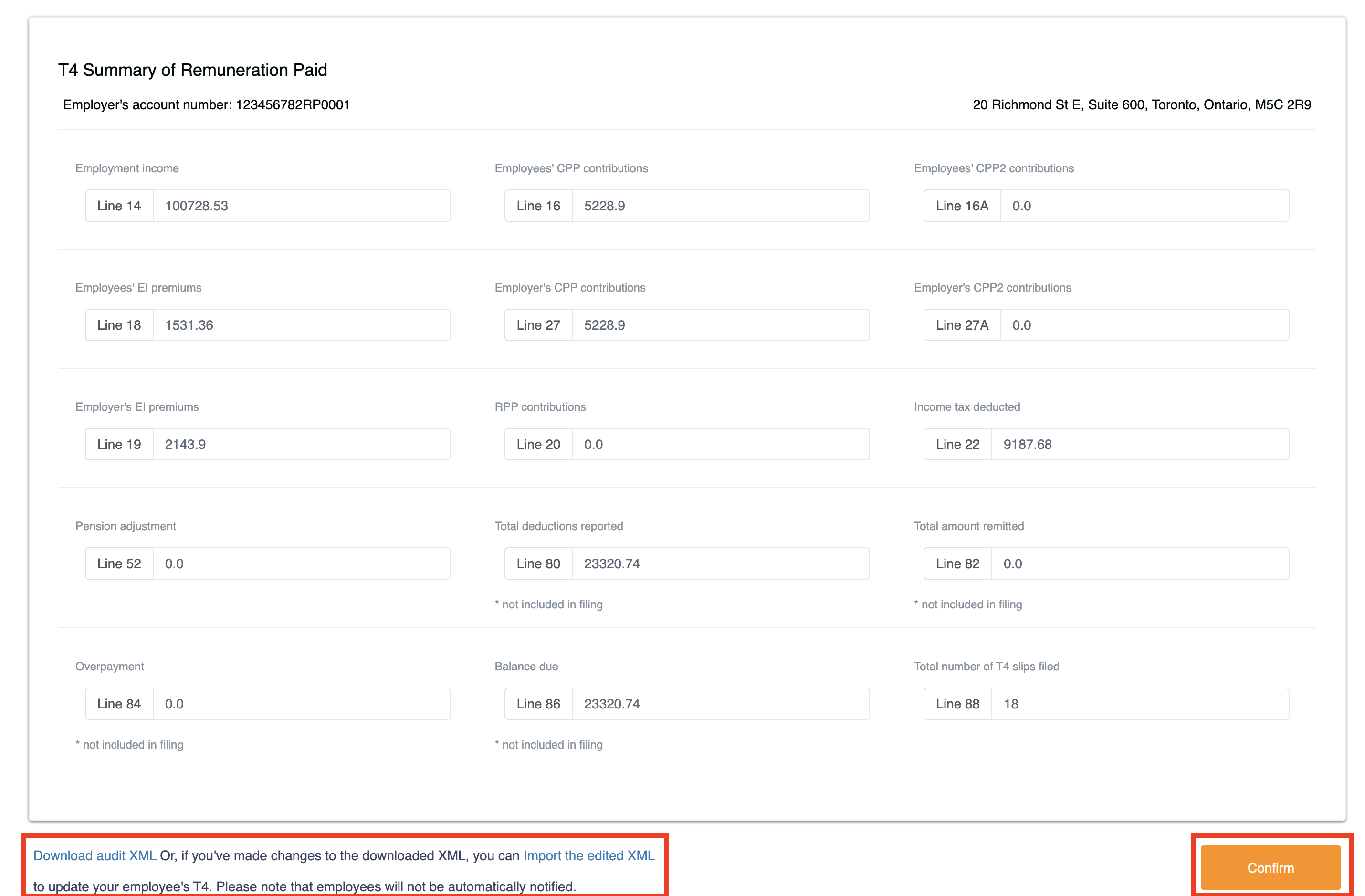

T4 Summary of Remuneration Paid

Knit will generate the T4 summary. Please review these amounts, focusing particularly on the figures in Box 82 for "Total Remitted." You can verify this amount in your My CRA business account. Note: The CRA audits remittance deficiencies based on the amounts in their system; inaccuracies in your T4 summary for Box 82 alone will not trigger a PIER.

If you need to edit an employee's T4, you can return to the previous page by selecting the Undo confirmation icon at the top left of the page, next to the printer icon.

Confirm the T4 package by clicking "Confirm" at the bottom of the T4 summary.

Once the T4 Package is confirmed, you will not be able to make any future edits. The T4s will be available to employees as soon as the T4s are confirmed.

Note: If you need to make changes for any reason, please contact support@knitpeople.com to un-confirm your T4s. As long as the T4s deadline has not been reached or Knit has not filed the T4s, T4s can be un-confirmed.

Choosing how to file

When confirming the T4s, you have two options for filing your company's T4s:

1. Myself: Download the XML file and submit your T4s directly to the CRA. The deadline for filing with the CRA is Friday, February 20th, 2026, at 8pm EST.

2. Knit: Allow us to assist you in completing your T4 filings. The deadline for this option is Monday, March 2nd, 2026

Once confirmed, you can print the official T4s by selecting the printer icon at the top right corner of the page.

Distributing T4s to Employees

If you have successfully confirmed your T4s using the process outlined above, the T4s will be accessible to your employees as soon as they are confirmed. Employees can locate their T4s on Knit by navigating to My Profile → Documents → Year End Documents. In this section, they will find T4s for the current year and the preceding years for which their T4s have been filed with Knit.