What is PD27?

In response to the introduction of the the 10% Temporary Wage Subsidy for Employers (TWS), CRA has created the PD27 report for employers who have used or intend to use the TWS to self-identify the amount of subsidies claimed. Since this amount forms part of your payroll remittance, the CRA will use the information on this form to reconcile the subsidy on your payroll program account. This will ensure that you do not receive a discrepancy notice.

Why is the PD27 Important?

This year every company that took advantage of the PD27 will show a balance owing on their T4 Summary of Renumeration. The T4 Summary is the sum of the slips plus employer portions of CPP and EI. If that sum does not equal to what CRA received it will show a balance owing. CRA will be using the PD27 report to offset the amounts owing.

So for example if your T4 Summary says you owe $10,000.00 and you filed your PD27 stating you claimed $10,000.00 then the remittances balance and you owe nothing.

T4 Box 80, 82 and 84

Please note that if you took advantage of the TWS, Box 80 (deductions reported) and Box 82 (Remittances paid) totals will not match and a balance in Box 84 (amount due) will appear. The Box 84 total should match the amount of TWS the company has claimed. If you want to double-check the amount remitted, please refer to the PD7A report (located in Knit Under Reports > Payroll Reports > PD7A).

File your PD27 as soon as possible

You do not need have to wait till after you file your T4s before submitting your PD27 form, and it is recommended that you complete and submit it as soon as possible to ensure that you do not get a notice of discrepancy. For more information on the PD27 10% Temporary Wage Subsidy Self-Identification form for employers, visit this page at Canada.ca.

Required Information for the PD27 form

- Total remuneration (gross pay) paid from March 18 to June 19, 2020

- Federal, provincial, or territorial income tax deducted from the remuneration paid

- Canada Pension Plan contributions (CPP), Employment Insurance premiums (EI) deducted from the remuneration paid

- Total number of eligible employees employed from March 18 to June 19, 2020

Knit's PD27 Report

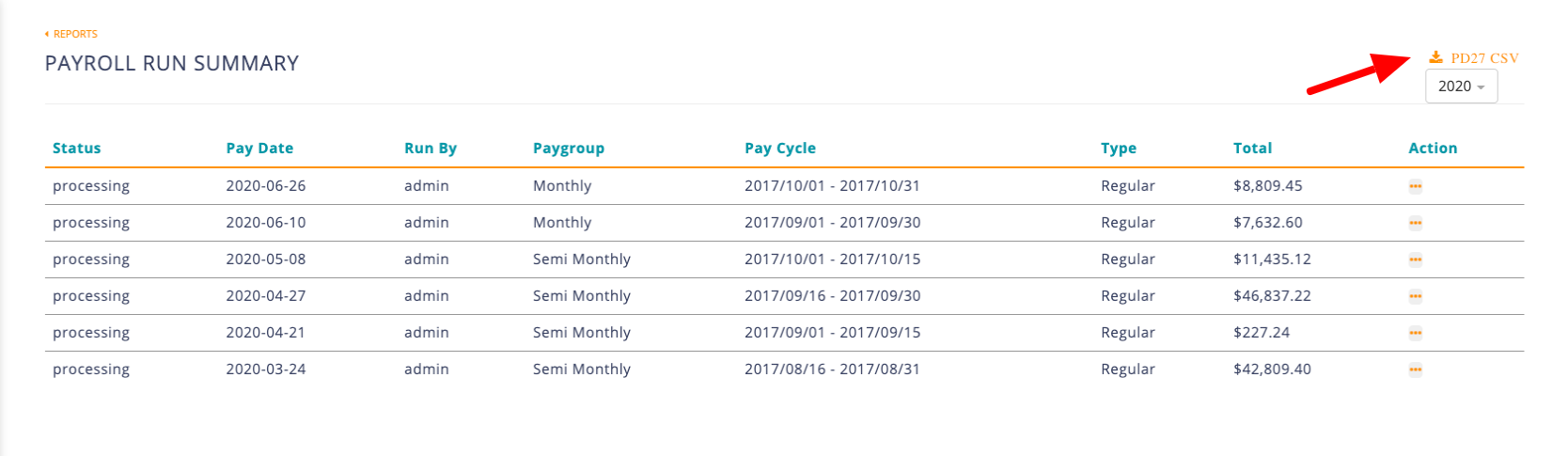

Completing the PD27 10% Temporary Wage Subsidy Self-identification form with Knit is an easy process for employers & accountants. To access the PD27 report:

- Open Reports > Payroll Reports > Payroll Summary

- In the top right corner, above the year drop-down menu, select the orange PD27 CSV download.

- This will queue a CSV file download; a report will be generated with the following information:

- Gross Pay

- Income Tax deducted

- CPP & EI contributions

- Number of employees

FAQ

Q: How do I complete the PD27 Self Identification form if I have not applied the TWS to all of my payrolls?

A: When you complete the PD27 Self Identification form, include all eligible payrolls regardless if the subsidy has been applied or not. If you have not applied the TWS to all payrolls, indicate which ones have not had remittances deducted in the form's notes section.

Please note that Knit's PD27 CSV will only include data from the payrolls processed on the platform. You might need to adjust your totals on the PD27 form if you did not have the subsidy applied to all eligible payrolls.